Understanding the Martingale Method Pocket Option

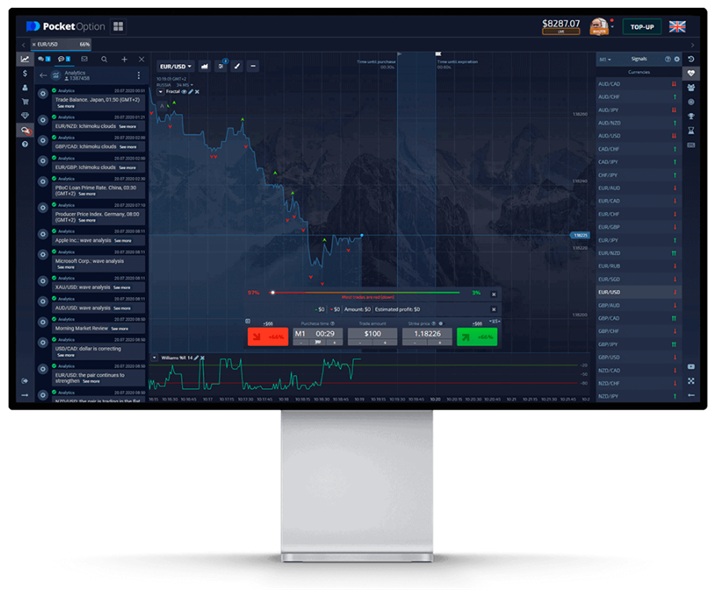

The Martingale Method Pocket Option метод Мартингейла is one of the most well-known betting strategies, which has gained popularity not only in gambling but also in financial trading, particularly in platforms like Pocket Option. This approach involves doubling the investment after a loss in hopes of recovering previous losses, and potentially making a profit. While the strategy offers a tantalizing appeal to traders, it’s essential to understand how it works, its advantages, its risks, and the best practices for effectively implementing it.

What is the Martingale Method?

Originally conceived as a gambling strategy, the Martingale Method revolves around a simple principle: if you lose a bet, you double your next bet. The reasoning here is straightforward — when you finally win, you will recover all your losses plus gain a profit equivalent to your initial bet. In trading, this means increasing your investment in the next trade after a loss, with the hope that this time you will win.

How the Martingale Method Works

In the context of Pocket Option, the Martingale Method can be applied to binary options trading. Suppose you start with a $10 investment. If you lose that trade, you invest $20 in the next trade. If you lose again, you increase your investment to $40, and so on. The formula can be summarized as follows:

- Initial Bet: $10

- First Loss: Bet $20 (total loss of $30)

- Second Loss: Bet $40 (total loss of $70)

- Third Loss: Bet $80 (total loss of $150)

The goal is to eventually win, which will allow you to recover not only your losses but also earn a profit.

Advantages of the Martingale Method

There are several advantages to employing the Martingale Method on Pocket Option:

- Potential for Recovery: The method allows traders who experience losses to recover their funds quickly upon winning a subsequent bet.

- Simple to Understand: The strategy is straightforward and easy to implement, making it accessible to novice traders.

- Short-term Success: In the short term, if a trader has a winning streak, they can see quick profits without significant risk.

Risks Involved with the Martingale Method

Despite its advantages, the Martingale Method comes with considerable risks:

- Large Capital Requirement: The need to double bets can lead to a rapid depletion of a trading account. Traders may find themselves needing to invest significantly more capital after a series of losses.

- Market Limitations: In a trading platform like Pocket Option, there may be limits on how much one can bet, which can hinder the use of the Martingale strategy effectively if a losing streak continues.

- Emotional Stress: Dealing with the pressure of increasing stakes can affect a trader’s emotional state, potentially leading to poor decision-making.

Best Practices for Implementing the Martingale Method

To use the Martingale Method on Pocket Option effectively, consider the following best practices:

- Set a Budget: Before you start trading, define a clear budget that you are willing to risk. Stick to this limit no matter what.

- Limit Your Trades: Avoid overextending yourself. Set a limit on how many consecutive losses you are willing to accept before stopping.

- Choose Your Trades Wisely: While the Martingale Method is about recovering losses, it’s crucial to choose trades that you have a reasonable confidence in. Research and use technical analysis to identify trends.

- Practice on a Demo Account: Before committing real money, practice the strategy on a demo account to gain experience and confidence without financial risk.

Conclusion

The Martingale Method on Pocket Option can be a useful strategy for some traders, offering a way to recover losses and generate profits. However, it is essential to approach this method with caution and awareness of its risks. By following best practices and understanding the intricacies of trading, you may harness the potential of the Martingale Method, transforming what is often viewed as a gamble into a calculated strategy for success. Always remember to trade responsibly, and consider the implications of using such a method on your overall trading strategy.